The Only Guide for Feie Calculator

Table of ContentsFeie Calculator Things To Know Before You Buy7 Easy Facts About Feie Calculator ShownThe 4-Minute Rule for Feie CalculatorThe Definitive Guide to Feie CalculatorAbout Feie Calculator

US expats aren't limited only to expat-specific tax obligation breaks. Typically, they can declare a lot of the same tax credit reports and deductions as they would certainly in the United States, including the Kid Tax Obligation Credit Score (CTC) and the Life Time Discovering Debt (LLC). It's possible for the FEIE to decrease your AGI so much that you do not get specific tax credit scores, though, so you'll need to ascertain your qualification.

The tax obligation code says that if you're a united state citizen or a resident alien of the United States and you live abroad, the IRS taxes your worldwide income. You make it, they exhaust it regardless of where you make it. However you do get a great exclusion for tax obligation year 2024.

For 2024, the optimal exclusion has been raised to $126,500. There is likewise an amount of certified real estate costs eligible for exemption.

The 7-Minute Rule for Feie Calculator

You'll need to figure the exemption initially, since it's restricted to your foreign made revenue minus any international real estate exemption you assert. To get approved for the foreign earned earnings exemption, the international real estate exemption or the foreign real estate reduction, your tax home should be in an international nation, and you should be one of the following: A bona fide local of a foreign country for an undisturbed period that includes an entire tax year (Bona Fide Homeowner Examination).

for a minimum of 330 full days during any duration of 12 consecutive months (Physical Presence Test). The Authentic Homeowner Examination is not appropriate to nonresident aliens. If you state to the foreign government that you are not a homeowner, the test is not pleased. Qualification for the exclusion could also be affected by some tax obligation treaties.

For United state citizens living abroad or gaining revenue from international resources, questions frequently develop on exactly how the U.S. tax obligation system uses to them and how they can make sure conformity while lessening tax obligation liability. From comprehending what foreign income is to navigating numerous tax obligation forms and deductions, it is essential for accounting professionals to understand the ins and outs of U.S.

Indicators on Feie Calculator You Need To Know

Jump to Foreign income is defined as specified income earned earnings gained outside resources the United States.

It's important to differentiate international gained revenue from other kinds of international earnings, as the Foreign Earned Income Exemption (FEIE), a beneficial U.S. tax obligation advantage, especially relates to this group. Investment earnings, rental earnings, and passive income from foreign resources do not qualify for the FEIE - Physical Presence Test for FEIE. These kinds of earnings may go through various tax obligation treatment

resident alien who is that citizen or resident of nationwide country with nation the United States has an income tax earnings tax obligation effect and result is a bona fide resident of a foreign country international countries for nations uninterrupted period continuous duration a consists of tax wholeTax obligation or A U.S. citizen united state person U.S.

Foreign earned income. You should have a tax home in a foreign country.

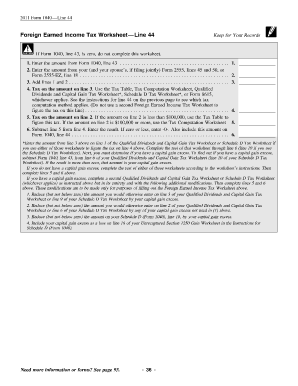

tax obligation return for international income taxes paid to an international government. This debt can offset your united state tax responsibility on international revenue that is not qualified for the FEIE, such as financial investment income or easy earnings. To claim these, you'll first need to qualify (Digital Nomad). If you do, you'll then submit extra tax obligation forms (Kind 2555 for the FEIE and Type 1116 for the FTC) and attach them to Kind 1040.

All about Feie Calculator

The Foreign Earned Earnings Exemption Go Here (FEIE) allows qualified people to omit a part of their foreign made earnings from U.S. taxes. This exemption can dramatically decrease or get rid of the U.S. tax obligation on international revenue. The particular quantity of foreign earnings that is tax-free in the U.S. under the FEIE can transform annually due to rising cost of living adjustments.

Comments on “Feie Calculator Can Be Fun For Everyone”